Key Things to Know Before Buying a Home in Toronto in 2024

If you’re planning to buy a home in Toronto in 2024, preparation is essential. Understanding the current market trends, how much you need for a down payment, and choosing the right neighborhood are just a few things to consider before starting your home search. In this guide, we’ll walk you through every step of the process to make your home purchase in Toronto as smooth as possible. By the end, you’ll know exactly how to buy a home in Toronto in 2024, from securing financing to closing the deal.

_________________________________________________

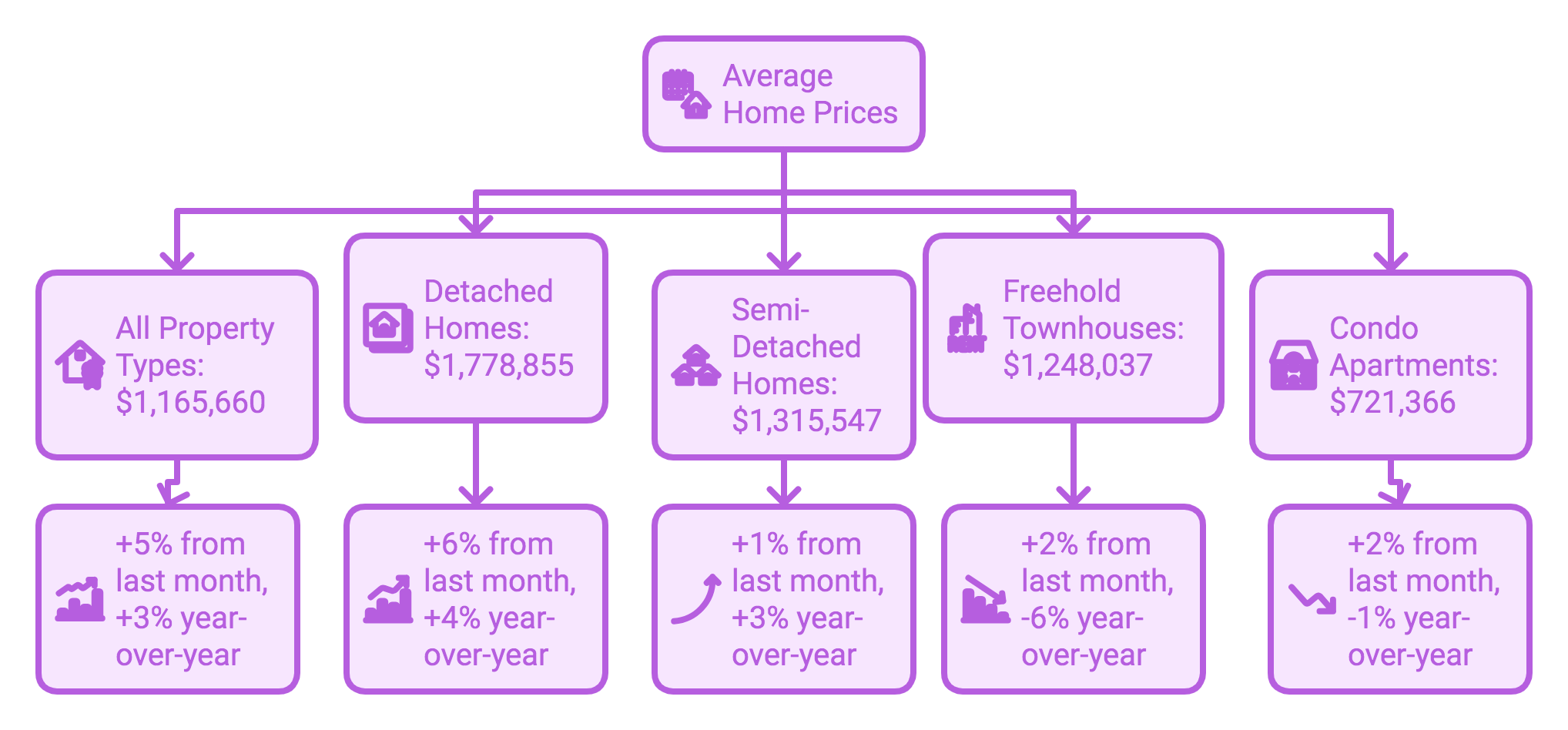

Toronto Real Estate Market: October 2024 Average Home Prices

Here’s a quick overview of Toronto’s current average home prices:

Toronto Real Estate Market Update: October 2024 – Explore the latest average home prices for all property types, detached homes, semi-detached homes, townhouses, and condos.

Toronto continues to be one of the most expensive real estate markets in Canada. Detached and semi-detached homes often exceed $1 million, with some neighborhoods surpassing even higher price points.

_________________________________________________

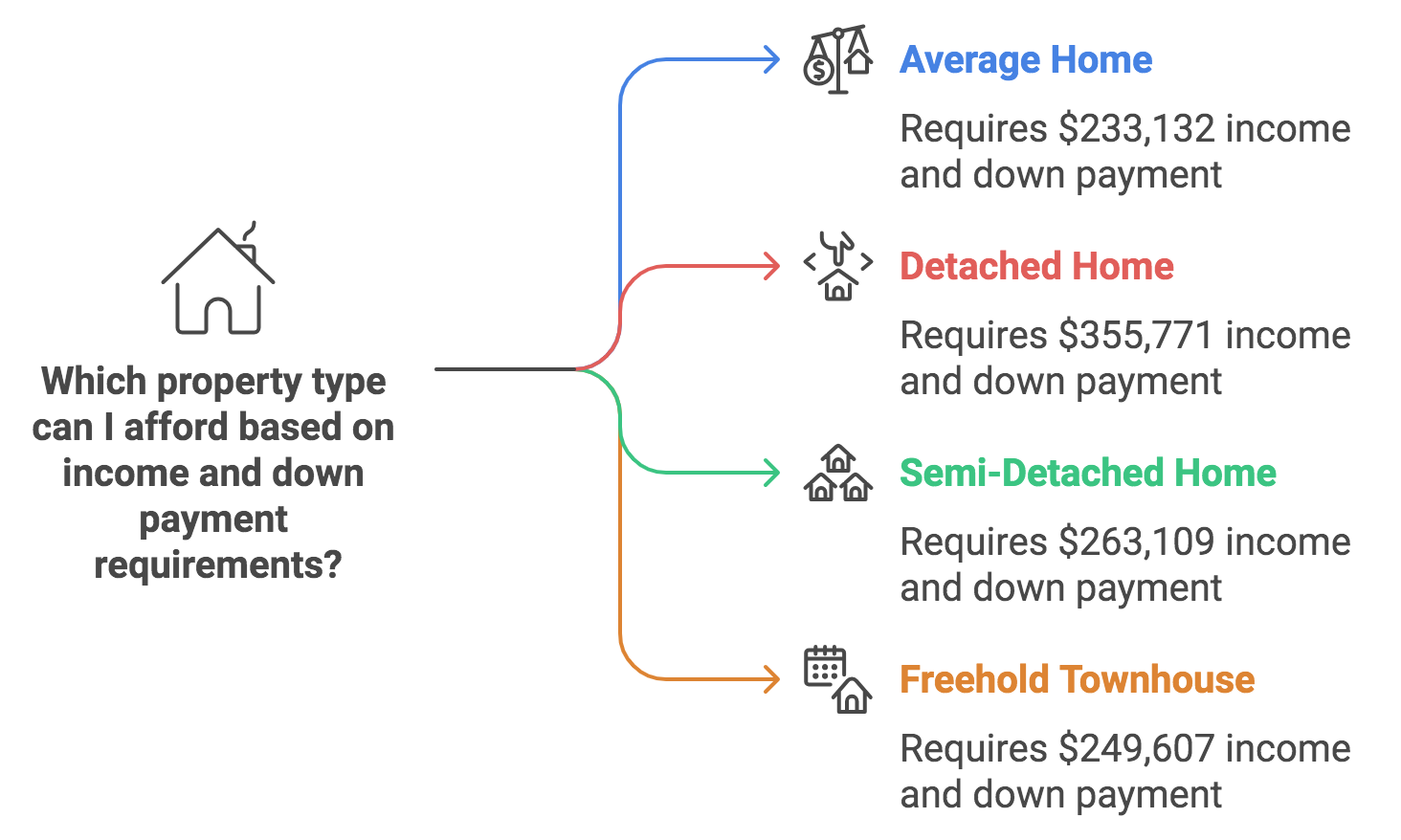

Income and Down Payment Requirements

Here’s what you need in terms of income and down payment for different property types:

Income and Down Payment Guide for Various Property Types.

Assessing your financial readiness is crucial, as these numbers help determine what you can afford.

_________________________________________________

10 Steps to Buying a Home in Toronto

Step 1: Save for Your Down Payment

In Toronto, many homes require a significant down payment. For properties over $1 million, you’ll need at least 20% down. For example, a typical detached home priced at $1,778,855 requires about $355,771. For homes under $1 million, the rules are different—5% is needed for homes under $500,000, and homes between $500,000 and $1 million require 5% for the first $500,000 and 10% for the remainder. If your down payment is less than 20%, you’ll face additional costs like mortgage insurance, which can range from 2.8% to 4% of the loan.

Step 2: Boost Your Credit and Income

Lenders will closely assess your credit score and income. To access better mortgage rates, aim for a credit score of at least 600. Reducing debt and ensuring your income meets affordability standards will also increase your chances of approval. Stability in employment—typically two years in the same role—is essential. If you’re self-employed, consistent income records are necessary.

Step 3: Determine Your Mortgage Affordability

Use mortgage calculators to gauge how much you can afford. Lenders typically evaluate Gross Debt Service (GDS) and Total Debt Service (TDS) ratios, which compare your income to mortgage and debt payments. Reducing your debt or increasing your down payment can help you qualify for a higher mortgage.

Step 4: Choose the Right Neighborhood

Toronto offers a variety of neighborhoods, each with its unique charm. Whether you’re drawn to the hustle and bustle of downtown or prefer the quieter suburbs, consider factors like proximity to schools, transportation, safety, and local amenities. Take time to compare different areas to find one that suits your needs and lifestyle.

Step 5: Budget for Closing Costs

Don’t forget about closing costs! These can include lawyer fees, land transfer taxes, and home inspections. Expect to pay about 3%-4% of the home’s purchase price in additional costs.

Step 6: Get Pre-Approved for a Mortgage

Pre-approval is a critical step. It shows sellers you’re serious and helps you understand how much you can borrow. Shop around to find the best mortgage rates and terms.

Step 7: Hire a Real Estate Agent

A knowledgeable real estate agent is invaluable. They’ll guide you through the complexities of buying a home, negotiate on your behalf, and ensure all paperwork is handled smoothly.

Step 8: Start House Hunting

Now, it’s time to start your search. Keep your budget and neighborhood preferences in mind. Visit open houses, take notes, and consider each property’s potential for renovation or future resale value.

Step 9: Make an Offer

Once you’ve found your dream home, it’s time to make an offer. Your agent will help you draft a competitive offer, and be prepared for negotiations, as Toronto’s market can be competitive.

Step 10: Finalize the Purchase

After your offer is accepted, complete a home inspection, finalize your mortgage, and wrap up all closing paperwork. Once everything is in place, you’ll be ready to move into your new home!

________________________________________________________________________________

By following these steps, you’ll be well on your way to purchasing a home in Toronto. Whether you’re a first-time buyer or an experienced homeowner, preparation is crucial to ensuring a smooth and successful purchase.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link